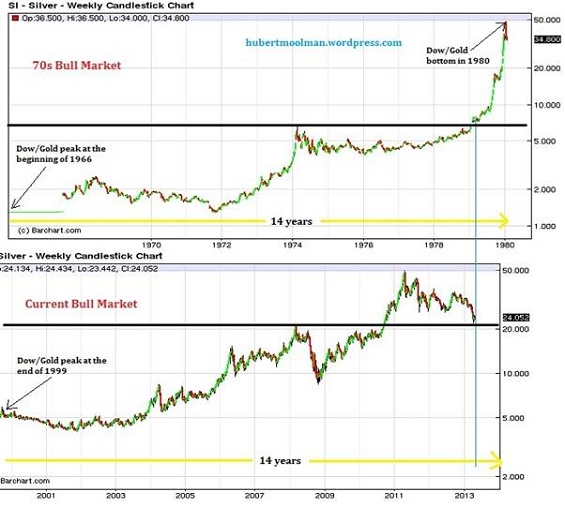

Summary: Silver is currently sitting at just under 1/2 the price it was back in 2011 when it peaked at over $48. This fact alone is discouraging for the metal’s prospects, but a closer look at some historical data shows some interesting parallels between today and the last big bull market in the 1970s. For example, both bull markets started at a peak in the Dow-to-Gold ratio. When the 70s bull market ended in 1980, this ratio was at a historic low. If we compare price charts from the days of disco to now (below), we can certainly see similarities in the patterns. A similar situation occurred in 1974 when prices peaked then plunged. Many believed this was the end of the bull market, when in fact it was a consolidation/correction before moving higher once again. Even at the $48 peak in 2011, silver still hadn’t hit the high of early 1980. This analysis claims that as long as silver doesn’t fall too far below its 2008 peak of $21, the bullish pattern will remain intact. Read more…

Home » Silver Bull Market is Following the Structure of the 70s Bull Market

Silver Bull Market is Following the Structure of the 70s Bull Market

May 10, 2013 by MetalsWired Editor

Filed Under: Precious Metals Investing, Silver